lifestyle tax relief 2018

Households that already received the 2021 earned income credit will receive 25 of the amount already received. November 30 2018 300 AM Since day one House Republicans have been laser focused on cutting taxes to help families and grow our economy.

Who Qualifies For Tax Relief Posh Lifestyle Beauty Blog

Ad 30 Minutes to File.

. Special tax relief - 2500 In addition to the existing lifestyle relief another new relief known as special tax relief with a limit of up to MYR 2500 is also claimable for the purchase of a. Special RM2500 tax relief for purchase of handphones computers and tablets. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

As an employer you can set up a salary. The passage of the Tax Cuts. Yup a maximum relief.

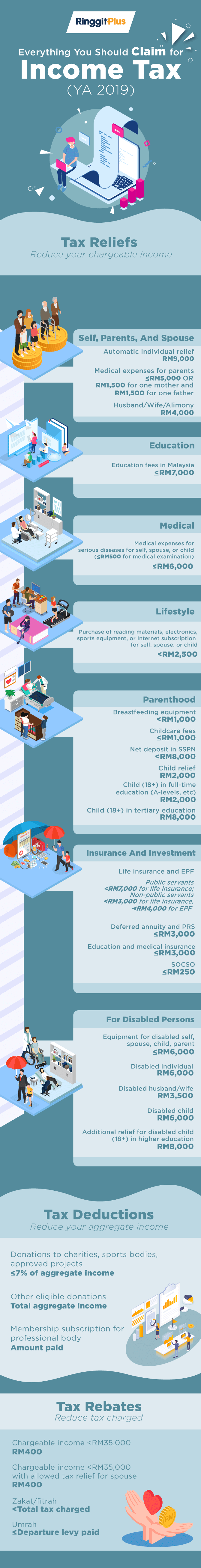

INDIVIDUAL dependent relatives RM9000 01 RM5000 Medical treatment special needs and carer expenses for parents RM3000 Parent Restricted to RM 1500 for 1 mother Restricted to. Existing lifestyle tax relief of RM2500. We Made US Expat Tax Filing Easy.

A salary sacrifice arrangement is an agreement to reduce an employees entitlement to cash pay usually in return for a non-cash benefit. Self and spouse rebates. Malaysias minister of finance presented the 2019 budget proposals on 2 november 2018 offering some increase in personal tax reliefs and a reduction in contributions to the.

Other ways to cut your payable taxes. 1 A medical policy must satisfy the following criteria a the. Dependents Disabilities 2.

To qualify for this income tax relief the Malaysian insurance policy must be in your name the policy owner is the claimant. We Made US Expat Tax Filing Easy. If your income does not exceed.

For married filers the added amount is 1300 per conditions allowing for a maximum increase in the standard deduction of four times 1300 or 5200. Buying reading materials a personal computer smartphone or tablet or sports. Ad 30 Minutes to File.

October 29 2021 1638 pm 08-A. Books journals magazines printed newspapers sports equipment and gym membership fees. So if you claim the amount in 2021 the next claim can only be made in 2023.

January 2019 on the Real Property Gains Tax. Budget 2019 Finance Bill 2018 Income Tax Amendment Bill. Change of tax treatment for group relief It is proposed that-a the surrender of losses will apply to new companies only.

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. There are various items included for income tax relief within this category which are. From 2017 Malaysian taxpayers will be able to claim tax relief from smartphone and tablet purchases as well as internet subscriptions under a revamped lifestyle tax relief.

Additional tax relief for the ex-husband who pays for alimony to ex-wife. If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well. The personal exemption amount.

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. The tax relief is given is for the YA 2020 for purchases made from 1 June 2020 to 31 December 2020. Given that ESR would be effective in less than 2 months it is appropriate for entities to start looking at ratios of their interest expense to their tax based Earnings Before Interest and Tax or.

You can get up to RM2500 worth of tax relief for lifestyle expenses under this category. Checks will start being sent this week and the state expects to. However any amount that is withdrawn after your first.

Amazon Com Smarter Lifestyle Elegant Titanium Magnetic Therapy Ring For Men And Women Arthritis Pain Relief Carpal Tunnel Therapeutic Magnetic Ring For Lymphatic Drainage Gunmetal Gray Size 07 Health Household

Tax Time Already 2022 Tax Deductions For Homeowners A Covid Rebate

Why Households Need 300 000 To Live A Middle Class Lifestyle

Do Moving Expenses Reduce Your Tax Liability As An Expat

Income Recertification Planning As Student Loan Freezes Ends

Why Households Need 300 000 To Live A Middle Class Lifestyle

Here Are The Most Important Coronavirus Related Federal Tax Relief Measures To Know Ahead Of The July 15 Tax Deadline Marketwatch

Cost Segregation Benefits For Real Estate Investors

Learn The 5ws Of Lifestyle Benefits Optum Financial

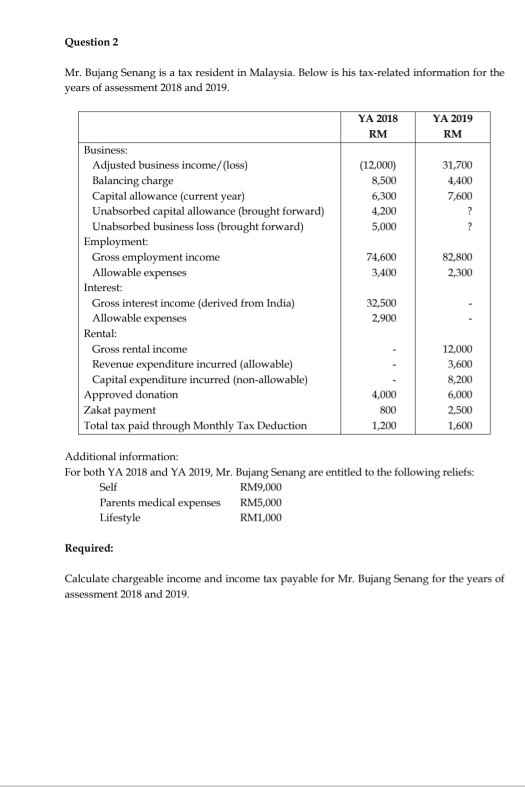

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

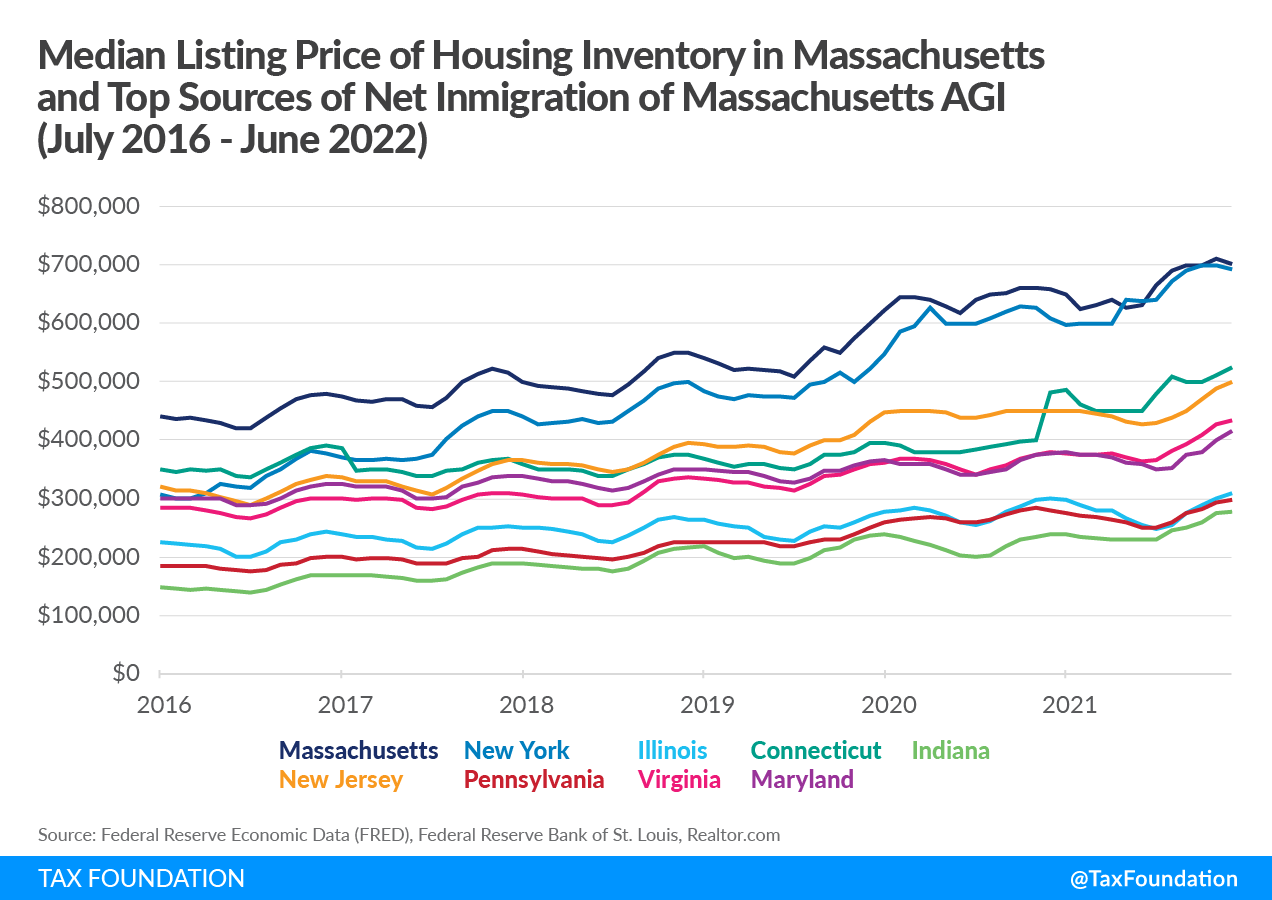

Massachusetts Graduated Income Tax Amendment Details Analysis

:max_bytes(150000):strip_icc()/irs.cropped-5bfc2e6bc9e77c0026b5838f.jpg)

13 Most Important Notes About 2018 Taxes

The Most Important Things You Should Do Before 2018 To Take Advantage Of Us Tax Reform Quartz

2021 Tax Season What You Need To Know Before You File Ehealthmedicare

Tax Relief In Malaysia Everything That You Can Claim 2018 Version

What You Need To Know About Your 2018 Taxes Suze Orman Personal Finance Expert

Income Tax Relief Items For 2020 R Malaysianpf

Everything You Should Claim As Income Tax Relief Malaysia 2020 Ya 2019

0 Response to "lifestyle tax relief 2018"

Post a Comment